Sixth Circuit Issues Strong Opinion Against For-Profit Religious Rights in Eden Foods Case

The challenges to the contraception mandate have very little to do with religious beliefs, the court held, and everything to do with a lack of corporate accountability.

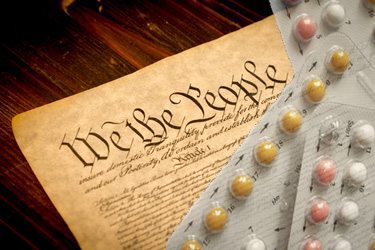

In the battle over the birth control benefit in the Affordable Care Act, the secular, for-profit corporations challenging the law’s contraception requirement have focused almost all of their arguments on the insidious overreach of the federal government into the personal religious practices of business owners. Of course, those craft chains, auto parts manufacturers, and processed foods businesses have done this on purpose. That’s because they’re engaged in a legal sleight-of-hand, a shell game in which one set of arguments serves as bait while another more pernicious argument advances. No matter what conservatives argue, the for-profit challenges to the birth control benefit are not about religious liberty, they are about a lack of corporate accountability.

On Thursday, the Sixth Circuit Court of Appeals made that clear in its opinion in Eden Foods v. Sebelius, when it held the individual plaintiffs lacked standing to challenge the mandate and that the for-profit, secular corporate plaintiff was not a “person” under the Religious Freedom Restoration Act. Following its earlier decision in Autocam, the court affirmed the denial of a preliminary injunction that would have blocked the Obama administration from enforcing the mandate against Eden Foods and sent the case back to the lower court to be dismissed for a lack of jurisdiction.

The opinion dismissing Eden Foods’ claims isn’t particularly long, but it makes clear the court is tiring of these challenges and sees them for what they really are: cloaked attempts to manipulate corporate law for individual gain. The plaintiff, Michael Potter—founder, chairperson, president, and shareholder of Eden Foods—is a Roman Catholic who challenged the mandate on the grounds it violates his “deeply held religious beliefs.” Citing an interview in Salon with Irin Carmon in footnote, the Sixth Circuit noted those beliefs were actually more of a “laissez-faire, anti-government screed” than a reflection of Roman Catholic ideology.

From there, the Sixth Circuit further uncloaked conservatives’ attempts to upend corporate law precedent under the guise of religious freedom. First, the court noted a panel of Sixth Circuit judges already came to the same conclusion earlier in the Autocam case, which meant absent intervention from the Supreme Court or an overruling of the Autocam decision by the entire Sixth Circuit it was bound to follow that decision here. But, the court noted, even if Autocam hadn’t been decided, the Supreme Court already set the law in 1982 in United States v. Lee, when it declined to grant a Social Security tax exemption under the Free Exercise Clause to Amish employers. The Supreme Court wrote:

When followers of a particular sect enter into commercial activity as a matter of choice, the limits they accept on their own conduct as a matter of conscience and faith are not to be superimposed on the statutory schemes which are binding on others in that activity. Granting an exemption from [statutory schemes] to an employer operates to impost the employer’s religious faith on the employees.

As to Eden Foods’ and Potter’s claims, the Sixth Circuit summed up the conservatives’ strategy and arguments like this:

By incorporating his business, Potter voluntarily forfeited his rights to bring individual actions for alleged corporate injuries in exchange for the liability and financial protections otherwise afforded him by utilization of the corporate form. Adoption of Potter’s argument that he should not be liable individually for corporate debts and wrongs, but still should be allowed to challenge, as an individual, duties and restrictions placed upon the corporation would undermine completely the principles upon which our nation’s corporate laws and structures are based. We are not inclined to so ignore law, precedent, and reason.

As Gretchen Borchelt, director of state reproductive health policy at the National Women’s Law Center, told Rewire in an email, “This unanimous decision by the Sixth Circuit in Eden Foods confirms once again that for-profit corporations and their owners cannot deny their employees health insurance coverage of birth control as guaranteed under the health care law. A boss’s religious belief should not trump women’s health and access to the health care they need.”

The Sixth Circuit’s decision doesn’t change the litigation landscape of the contraception benefit much for now. In addition to the Sixth Circuit, the Third Circuit Court of Appeals has also ruled against the challenges, while the Tenth Circuit Court of Appeals, in the Hobby Lobby case, ruled in favor of corporate for-profit religious rights. Both the Obama administration and Hobby Lobby have asked the Supreme Court to review that decision, and while the Roberts Court has not acted on that request yet, it’s a safe bet it will sometime this term. The question is, will the Court that upended years of precedents in the the Citizens United decision to create corporate, constitutional speech rights do the same for corporate religious exercise rights?